Overview

The Affordable Care Act (ACA) created reporting requirements under Code Section 6056. These rules require large employers to provide information to the IRS and to their full-time employees regarding whether they offer health plan coverage to their full-time employees.

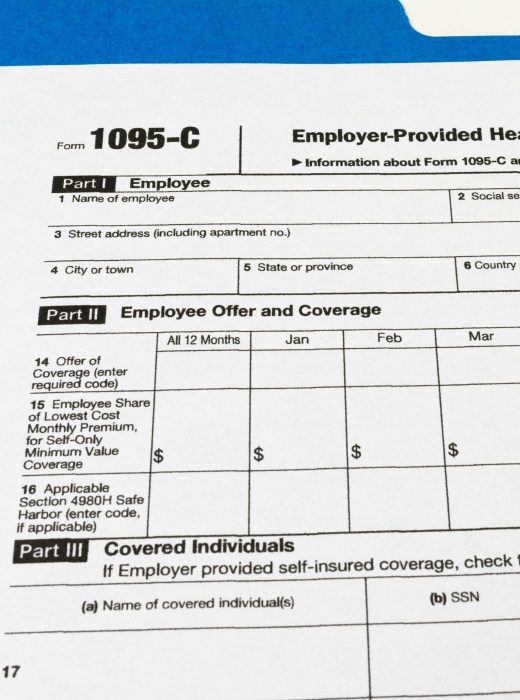

This information will be reported using Forms 1094-C and 1095-C. By now, all large employers should be familiar with the 1095-C form, and should have a filing process with the IRS.

Types of Providers

Generally, employers produce and file ACA reporting from one of three provider types:

• Specialty providers, including accounting firms,

• Payroll companies, and

• Benefits administration solutions.

What to Know

For a solution to be effective, it should be both accurate and simple. Ask questions like:

• How are full time employees determined?

• Are offers of coverage properly documented?

• Can you report whether an affordable offer of coverage was made?

• Will the employer get assistance coding the forms?

• How will the provider assist in identifying possible issues?

• Does the provider have single sign on with the IRS?

Self-funded Health Plans Raise the Stakes

One factor that can make Affordable Care Act reporting considerably more complex is if a company has a self funded medical insurance plan. The self-funded employer will need to do more than its fully insured counterpart because the company will need to report covered employees and dependents by month.

Minimum Needs

You’re on the right track when you have a system that can:

• identify and report full time employees,

• make and document offers of coverage,

• determine affordability of each offer of coverage, and

• track and report covered employees and dependents by month.

You’ll Also Want

The strongest solutions will also help you:

• withstand disruption in your medical insurance provider without causing an undue burden on human resources departments

• withstand turnover in human resources departments so the process is transferrable to another person, and

• identify problems such as fine exposure and mismatched coding before forms are distributed and filed.

The Steele Solution

Steele customers utilize the ACA Reporting Module through the BenSelect software system to produce and file ACA Reporting. Within our system, employees are characterized as full-time or part-time. We make and document offers of coverage. We track covered persons by month and can withstand a change to your medical insurance company without disrupting your ACA processes. The software analyzes each affordability method to determine whether offers of coverage are affordable. The forms are automatically coded. The forms summary identifies potential mismatched ACA codes and warns of issues and fine exposure before forms are distributed. The solution is easy enough to be executed by your HR department with minimal training required. And, we have single sign on with the IRS.